These practices will go a long way in reducing the risk of unauthorized access to your accounts. Stolen credit card numbers are often used for online shopping sprees or to make in-store purchases through digital wallets. These transactions can happen across different countries, making them harder to trace. If your card is linked to auto-pay services or has a high spending limit, the damage can escalate quickly—often before your bank even flags it as suspicious. In early 2024, American Express notified customers of a data breach originating from a third-party merchant processor.

Analyzing 4 Million Payment Card Details Found On The Dark Web

Dutch cybersecurity firm EclecticIQ attributed the attacks to groups UNC5221, UNC5174, and CL-STA-0048. Attackers deployed web shells, reverse shells, and malware such as PlugX, KrustyLoader, SNOWLIGHT, VShell, and GOREVERSE. An exposed server tied to the campaign contained event logs and targeting lists, revealing both compromised assets and future plans. The Fars news agency reported that the attack targeted the bank’s infrastructure, disrupting online services, though officials expected to restore full service within hours. Users are urged to change passwords, enable multi-factor authentication, and watch for suspicious activity. This breach is among the largest ever recorded and underscores the ongoing threat posed by infostealer malware.

These generated numbers link to your real card but can be limited by merchant, amount, or time. Early detection enables your security team to prevent a transaction, minimizing the risk of a chargeback. Require multi-factor authentication for high-risk transactions, but it needs to be implemented intelligently. Pattern recognition through machine learning has revolutionized how we spot compromised cards.

Data Breaches That Occurred In April 2024

If your credit card number or other details are detected on the dark web, you will be immediately alerted, allowing you to take protective measures. Equifax credit monitoring & ID theft protection features for one adult. The hackers disrupted claims processing for months and stole extensive data including names, contact info, Social Security numbers, and medical records.

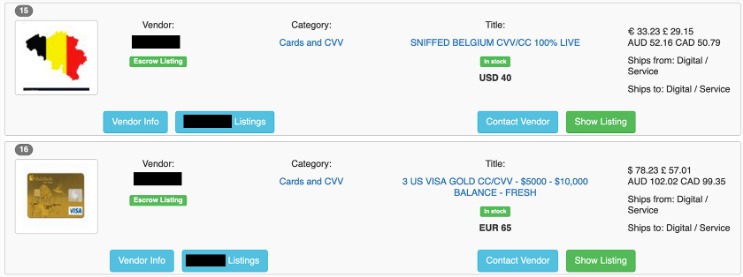

The key is catching this activity before large volumes of card data make it to market. This enables systems to detect fraud based on minute changes in transaction velocity, merchant category patterns, and even the time of day purchases are made. Financial institutions tighten their security measures to prevent fraud but that also prevents legitimate transactions as a result. The pricing varies based on the card type, with premium cards from certain banks fetching higher prices.

The Magical Comeback: Kaspersky And BIZONE Report New PipeMagic Activity In Saudi Arabia And Brazil

These platforms serve as hubs for cybercriminals to buy and sell compromised payment card details. Dark web monitoring platforms, such as Lunar, provide an automated solution to safeguard personal identifiable information (PII) and credit card details. These platforms continuously scour the deep and dark web, looking for any traces of your sensitive information. By setting up alerts, businesses can receive notifications whenever their PII or credit card information appears in suspicious contexts.

How A PayPal Account Or Credit Card Ends Up On The Dark Web

The hackers used a combination of phishing and malware to gain access to the company’s systems. They then extracted sensitive information, including credit card numbers, expiration dates, and security codes. One such forum was seen offering to give away a million credit cards for free just as a marketing exercise, for goodness sake. Now Kaspersky threat intelligence specialists have revealed the extent to which infostealer malware and bank card theft go hand in hand.

- The data was entered into a spreadsheet for analysis, allowing researchers to calculate statistics and identify trends.

- Data breaches have become a fact of life, but taking proactive steps can help minimize the damage.

- The release of this data poses significant risks for financial institutions and individual cardholders alike.

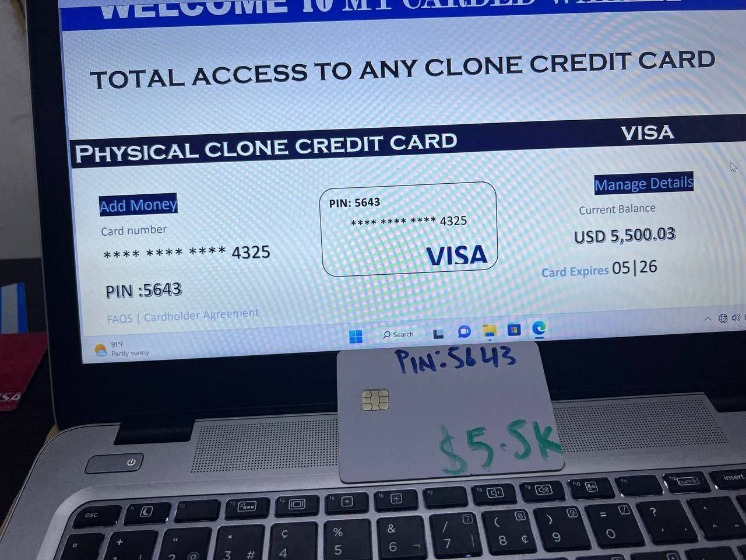

- Card checkers are tools used by threat actors to verify the validity and authenticity of credit card information they purchase on the dark web.

Preventing Credit Card Fraud: Best Practices

Louis Vuitton has confirmed multiple data breaches impacting customers in Turkey, South Korea, and the United Kingdom. The breaches, which occurred in June 2024, were linked to unauthorized access through a third-party service provider’s account. On November 7, 2024, Finastra, a London-based financial technology company, detected unauthorized access to its secure file-transfer platform.

One of the main challenges has been inconsistent cooperation across crypto platforms. The exchange eXch allowed over $90 million to be moved through its systems before taking action. While ByBit’s CEO Ben Zhou emphasized that no customer funds were affected and the firm has replenished the stolen amount through investor loans, the company launched a Lazarus Bounty program.

The breach resulted from a phishing campaign targeting IDHS employee accounts, leading to unauthorized access to personal information, including Social Security numbers, names, addresses, and public assistance account details. In July 2024, AT&T disclosed a major data breach affecting nearly all of its wireless customers. Hackers exploited a vulnerability in a third-party cloud platform, Snowflake, to access call and text metadata, including phone numbers and timestamps, from May 2022 to January 2023.

How Technology Is Evolving To Counter Card Fraud On The Dark Web

The breach involved the theft of approximately 400 gigabytes of data, potentially affecting sensitive information from major financial institutions. Marks and Spencer (M&S) has confirmed a cyberattack that occurred in April 2025, exposing customer data. While payment details were masked and not usable, the breach involved basic contact information, dates of birth, order histories, and possibly reference numbers tied to M&S credit card and Sparks Pay accounts. Some criminals organize stolen card data by ZIP code, according to Novak, “because it makes it harder to conduct fraud detection,” he says. This is because criminals can purchase cards to use in their own geographical locations to limit the chances that their transactions will be flagged.

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. In today’s digitally connected world, the risk of credit card theft has evolved far beyond physical theft.

If you suspect your card details have been stolen, you should immediately call your bank or credit card company. They can freeze the card and investigate further to trace usage details, suspicious activities, and other signs of theft. A data breach occurs when confidential or protected information is exposed to unauthorized people or endpoints.

A hacked Netflix 1-year subscription retails at $25; an HBO account is $4, a Bet365 account is $40, and a hacked Uber account will set a cybercriminal back $15. “This is the second major leak of cards relating to Indian banks detected by Group-IB Threat Intelligence team in the past several months,” comments Dmitry Shestakov, head of Group-IB’s cybercrime research unit. UPDATED A database featuring more than 460,000 payment card records – almost all from India – is being offered for sale through a darknet bazaar, threat intel firm Group-IB warns. The analysts claim these cards mainly come from web skimmers, which are malicious scripts injected into checkout pages of hacked e-commerce sites that steal submitted credit card and customer information. BidenCash is a stolen cards marketplace launched in June 2022, leaking a few thousand cards as a promotional move. Sometimes, the person stealing your card information is right in front of you.

This proactive monitoring enables businesses to track and investigate potential threats in real-time, helping to prevent fraud before it can impact their operations. The use of such platforms is crucial for maintaining the integrity and security of customer data, and it provides an additional layer of defense against cybercriminal activities. The “massive collection of sensitive data containing over 1 million unique credit and debit cards,” was published to the criminal forum on Feb. 19 and contained six archives comprising a total of 1,018,014 cards. Card data is a hot commodity on the dark web, with credit card details and cloned cards being sold to cybercriminals. These stolen cards can be used for financial gain through unauthorized charges, account takeover, and identity theft.