Designed to emulate NFC cardsthrough HCE, the application enables unauthorized access tocontactless systems, including payment terminals and credit cardinfrastructure. Primarily, the actors use Android-based phones, with numerous cards “loaded” into mobile wallets for further fraud. In one such instance, cybercriminals specifically focused on fraud automation against Barclays, Lloyds, Halifax, HSBC, WISE, Santander, Bank of Scotland, and Revolut. Then there’s Jenna, a college student whose passion for online shopping and social media made her a prime target. Jenna inadvertently clicked on a phishing link embedded in a seemingly harmless advertisement.

The group, which calls itself “All World Cards,” offers stolen credit card information to other criminals. It has built a reputation for being a reliable source of stolen credit card data and PII. Renowned for its extensive inventory of financial data and sophisticated operating methods, Brian’s Club is a key player in the underground economy of financial cybercrime. When NFC-based identity systems can be spoofed, the consequences could be severe across sectors relying on contactless authentication, such as physical or digital access control, payments, and transit systems. Attackers could clone or emulate legitimate credentials, gaining unauthorized access to secure locations, conducting fraudulent transactions, or impersonating individuals for malicious purposes. Furthermore, widespread spoofing could delay the broader adoption of mobile ID technologies, prompting stricter regulatory scrutiny and costly upgrades to more secure authentication.

Its interface is easy to navigate, and it has a reliable escrow system, as well as allowing payments with Bitcoin and Monero. All of this has made it one of the most reliable markets still active in 2025. If you receive an alert that your information has been compromised, it’s worth changing your sign-in information as quickly as possible. Still, because users are anonymous, the dark web is also used as an online black market by criminals for illegal activities like selling stolen information.

How To Protect Your Personal Information From Fraud

Numerous banks, FinTechs, and credit unions have reported increased NFC-related fraud and highlighted significant challenges in early detection. Chinese cybercriminals demonstrate high adaptability in exploiting NFC technologies for fraudulent purposes and create new tools to facilitate illegal operations at scale. They target financial institutions to defraud consumers and cause substantial economic losses for the global economy. In today’s digital age, being aware of dark web activities means understanding how easy access to stolen credit card data can wreak havoc on your financial health. But don’t worry—we’re here to break it all down in a way that’s as engaging as binge-watching your favorite show.

Exploring Benefits And Risks Of Using Credit Cards Or Card

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more. Your personal information can sell for upwards of hundreds or even thousands of dollars on the dark web—and you might not even know it’s even out there to begin with.

Checking Accounts

Illegal activities thrive on the dark web, including the illicit trade and sale of credit card information. Criminals use stolen credit card data to make unauthorized transactions, purchase illegal goods, or fund other illegal activities. The dark web provides an anonymous and unregulated platform for these transactions, making it difficult for authorities to trace and shut down such activities. The repercussions of dark web credit card marketplaces, including the rise and fall of Joker’s Stash, extend beyond monetary losses. Financial institutions shoulder increased operational costs tied to investigating fraudulent activities and failed authentication attempts. Customers who lose their card data to fraud may turn to a different card while waiting for a replacement card, threatening the top-card effect of passing all spending across one preferred card.

Identity Theft

Embrace the awareness, take actionable steps, and let every secure transaction remind you of your power in a world where technology is both your friend and a potential foe. Now that we’ve journeyed through the murky corridors of the dark web and uncovered some of its secrets, it’s time for the good stuff—tips and tricks to help you dodge the bullet of a data breach. Whether you’re a savvy digital native or just starting to navigate online transactions, these practical strategies can keep your financial health in check. Kaspersky advises individuals and organizations monitor bank notifications, enable two-factor authentication and run full security scans on all devices to remain vigilant against these types of malware threats. When Torrez closed in December it was one of the largest English-language marketplaces in the world selling drugs, hacking tools, counterfeit cash and criminal services.

This EMV® 3-D Secure ACS delivers a secure, frictionless digital shopping experience, providing a multi-layered defence against unauthorized transactions. By adding an extra layer of authentication, financial institutions reduce the risk of fraudulent activities during transactions. This proven technology, seamlessly working in the background, analyses transaction data and authenticates users in real-time, ensuring only legitimate transactions proceed. Reaching its zenith as a notorious hub for stolen financial data, Joker’s Stash faced a significant setback when law enforcement agencies collaborated to take it down, along with many other high profile carding sites. This victory against cybercrime dealt a severe blow to the criminal underground, disrupting operations on one of the most prolific dark web platforms. You’re probably wondering how things like a PayPal account login or credit card details end up on the dark web.

Man Threatens To Sue Pharmacy After Prescription Mix-Up Exposes His Affair

Or, a call center worker can write down your information when you pay via credit card over the phone. Skilled hackers can take the stolen credit card number and replicate it onto a blank card using specialized equipment. The process, also called skimming, allows them to make physical purchases at ATMs or retail stores. Unlike online fraud, this type of theft is harder to detect because the transaction appears as a regular swipe.

Category #2: Details Needed For Physical Fraudulent Use

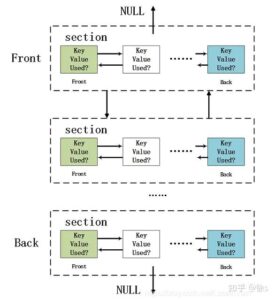

According to data from Merchant Savvy, global payments fraud has increased from $9.84 billion in 2011 to a staggering $32.39 billion in 2020. The illegal carding market, which can be accessed through the dark web, went live during June, 2022. Initially, this specific marketplace started out by leaking thousands of credit cards. From Social Security numbers to bank logins and medical records, cybercriminals buy and sell stolen data every day. Using stolen compromised payment data, Chinese cybercriminals automate transactions using tools like Z-NFC and NFC-enabled POS terminals, which are typically placed right in front of them.

Learn how to automate financial risk reports using AI and news data with this guide for product managers, featuring tools from Webz.io and OpenAI. Russian Market has consistently remained one of the most popular and valuable data stores on the dark web. The platform’s activity has increased significantly over the past year, indicating its growing influence and market share in the underground economy. Due to its extensive inventory and reputation for reliability, Brian’s Club has maintained a significant presence on the dark web. Quality and validity of the data it provides justify its higher cost over other marketplaces. The platform’s popularity continues to grow, attracting both new and returning customers.

- The fraudulent credit cards were used to purchase gift cards, flights, hotels stays, and other goods and services.

- Use this guide to learn how to easily automate supply chain risk reports with Chat GPT and news data.

- Withoutdecisive action, these cybercriminals will continue to exploit NFCtechnology, posing a serious risk to consumers and businessesworldwide.

- Though the number is significantly lesser than the 14 million credit cards dark web reported in 2021, it is still significant.

It is a hub for financial cybercrime and offers a wide range of illicit services and stolen data that cater to sophisticated cybercriminals. Thegrowing prevalence of NFC in everyday transactions underscores theurgent need for stronger security measures, enhanced fraud detectionsystems, and global cooperation to combat this rising threat. Withoutdecisive action, these cybercriminals will continue to exploit NFCtechnology, posing a serious risk to consumers and businessesworldwide.

“The most important thing is for people to keep an eye on their transactions and report any fraud immediately,” Krebs says. Unless you live the rest of your life only paying with cash, you’ll never be totally impervious to payment fraud. One of the largest known underground shops, Joker’s Stash, generated more than $1 billion before getting shut down in February, according to Gemini Advisory. A 2019 data leak of another shop, BriansClub — which appears to have been by a competitor, according to Threatpost —shows how pervasive this trend has become. All content provided on Web Design Booth is for informational purposes only and does not constitute professional advice.

- When using credit cards on the dark web, it is vital to use a secure payment method to minimize the risk of fraud.

- Telegram carding groups have become a significant threat in the cybercriminal community, with tens of thousands of members easily accessible through the chat application.

- All major credit card networks including Visa, Mastercard, Discover, and American Express offer $0 liability.

- Join us as we break down and discover the methodologies of card fraud using our dark web monitoring tool, Lunar.

- Criminals buy and sell credit card data, exploiting it for various illegal activities.

The dark web is a section of the internet that is not indexed by traditional search engines. It hosts a variety of sites, many of which are involved in illicit transactions, including the buying and selling of credit card information. Due to limited data on credit cards from other countries, we were unable to adequately compare prices for credit cards from different places. To protect yourself from credit card theft and fraud, be careful and be covered. A rogue restaurant employee can copy your card data when you’re not looking (this scam is called shoulder surfing).