This includes unreported labor, where workers are paid in cash without payroll tax deductions, and under-the-table business transactions that bypass corporate income tax obligations. The U.S. Internal Revenue Service (IRS) estimates that the “tax gap”—the difference between taxes owed and taxes paid—was approximately $688 billion annually as of 2021, with a significant portion attributed to unreported income. Operating discreetly, the black market involves the buying and selling of prohibited goods, often evading government regulations and taxes.

What Are Black Markets And How Do They Operate?

He has worked in research and marketing departments of five top commercial banks in Nigeria. The world of trading has evolved dramatically in recent years, fueled by advances in technology, data analytic… In today’s increasingly regulated and interconnected global financial landscape, the fight against financial c… If you’ve ever been left with a bitter taste in your mouth after shopping Black Friday sales, we feel you. Buyer’s remorse is something many shoppers experience after feeling pressured into buying something on Black Friday.

- One example of a grey market is the growth in online shopping that has occurred in Australia.

- Black markets are characterized by their inherent illegality, operating in direct violation of established statutes that define legitimate commerce.

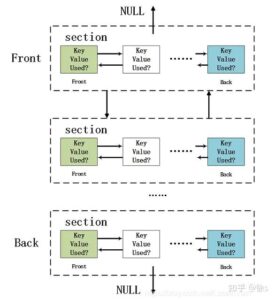

- At its core, the black market operates on the fundamental principles of supply and demand, offering goods and services that are either inaccessible within the legal market or come at a substantially reduced cost.

- This underground market involves illegal transport and trade of people for the purpose of forced labor, sexual exploitation, and other forms of modern-day slavery.

- For example, in some African nations, the trade of counterfeit goods and smuggled commodities provides livelihoods for many who are otherwise marginalized by the formal economy.

Traded Goods And Services

At times, prices can be lower if the seller has lower “overhead” because he or she stole the good or is avoiding high taxes. Ethical quandaries often arise in the context of the black market, especially when individuals feel compelled to turn to illicit sources out of necessity or perceived necessity. In situations where legal avenues fail to provide access to vital goods or services, people may face difficult decisions about supporting illicit activities. Striking a balance between satisfying immediate requirements and upholding ethical standards can be a formidable challenge. Addressing these dilemmas requires a multifaceted approach that includes not only providing legal alternatives but also addressing the underlying socioeconomic factors that drive individuals towards the black market.

Can I Pay For My Device Over Time?

An example of an illegal or black market would be the human trafficking market that engages in the capture of people throughout the world and their sale into various areas, such as forced labor and prostitution. A black market is any market where the exchange of goods and services takes place in order to facilitate the transaction of illegal goods or to avoid government oversight and taxes, or both. This was a digital market that used Bitcoin to launder money and to conduct illegal drug transactions and weapons sales. As for illegal currency markets, they exist primarily in nations with currency controls and weak economic fundamentals, such as a high inflation rate and low currency reserves.

Dollar To Naira: Understanding The Exchange Dynamics

Consumers are often willing to overlook the illegality of a black market transaction if they feel that the good or service is “harmless.” This is often the case with illegal prostitution and also applied to alcohol sales during prohibition. Although some people think that most illegal transactions are relatively harmless, the money generated is often used for nefarious purposes. The mafia in the U.S. thrived during prohibition, resulting in bloody battles over turf and profits. Governments combating illegal markets spend vast fortunes fighting organized crime and racketeering, and lose millions in tax revenues from the prohibited good.

Why Buy Refurbished Electronics On Black Friday?

Hidden Tor Servers are now the norm for storing, accessing and hiding illicit activity such as child pornography. The level of protection provided by Tor makes law enforcement’s job tracking such activities next to impossible. Given these disadvantages, tackling the challenges posed by black markets is a crucial task for governments, law enforcement agencies, and international organizations. A multi-faceted approach, ranging from economic development and law enforcement to regulatory reform and international cooperation, is often necessary to address the complexities of black market economies. But many generally law-abiding people find the underground economy helpful and even necessary, particularly if their governments are incompetent, autocratic or corrupt. For example, for the last few years in Venezuela the government has heavily restricted the amount of food, money and other necessities available in its official shops.

Questions Answered On Sex Trafficking In The US

During the petrol crisis in Nepal, black marketing in fuel became common, especially during mass petrol shortage. Petrol pump operators were alleged to hoard the fuel and sell it to black marketeers. Black marketing in vehicle/cooking fuel became widespread during the 2015 Nepal blockade; even after it was eased and petrol imports resumed, people were not getting the fuel as intended and resorted to the black market.

By staying informed, making conscious purchasing choices, and supporting legal alternatives, we can collectively work towards eliminating the black market and promoting a fair and regulated economy. People engage in black market activities due to various reasons, such as the desire for quick profits, limited access to certain goods, or dissatisfaction with formal market options. By adopting these practices, you can contribute to the eradication of black market activities and support legitimate trade.

- Firstly, the black market poses a significant threat to legal economies, undermining their stability and growth.

- This is particularly evident in developing countries, where informal economies can constitute a significant portion of overall economic activity but offer little in terms of social mobility or economic security.

- This is the case with unregistered firearms and cigarettes, which usually include a hefty local, state, or federal tax.

- The digital monetary system online is predominately operated by the likes of Paypal, Western Union, and banking companies that try to follow government regulations to prevent fraud and money laundering.

- Among those who may purchase weapons on the black market are people who are unable to pass the legal requirements for registration—convicted felons or those suffering from mental illness for example.

A black market is distinct from a grey market, which is the legal trade of goods through channels that are unofficial or unauthorized. Black market, trading in violation of publicly imposed regulations such as rationing laws, laws against certain goods, and official rates of exchange among currencies. It could refer to a wide range of products and services being bought and sold, including drugs, guns, or prostitution. A black market could also refer to legal activities that are sold illegally, which could include ticket resales, prescription drugs, or passes for a vacation destination.

Goods and services may be acquired in one country and then legally brought into another country and sold. There may be no legal restriction on this activity but it does affect the profitability of those trading in the normal manner in the country where the good or service is sold. Even in democratic countries like the UK, plenty of people are comfortable with at least some form of black market. For example, just under half (44 percent) of Brits say it’s okay for small traders, such as plumbers and cleaners, to hide some of their earnings in order to reduce their tax bill, usually by working for ‘cash in hand’. People buy from the black market because the good or service they want is difficult or impossible to get hold of legally (because, say, it’s banned in their country) or because they want to save some money (by, say, not paying any tax on it).

Black markets emerge due to a variety of factors, such as excessive regulations, high taxes, limited availability of certain goods, economic instability, or the presence of organized crime networks. Another problem with driving certain goods into the black market is that, when these goods are sold in secret, there is no one to insure their quality or safety. Manufactured by amateurs with no proper oversight, many of these products were defective and even hazardous.

Effects Of The Black Market

It doesn’t matter what it is, a black market arises when a government makes trafficking or possessing something which has a demand illegal. Are you in Lagos specifically and want to find out what the exchange rate is right now? The black market has existed for decades, helping ordinary Nigerians access USD when official channels are limited. Proper regulation, economic diversification, and strong security are key for long-term currency stability. Throughout history, the black market has displayed a remarkable resilience, adapting to changing circumstances and technological advancements, ensuring its continued presence on the fringes of society. The black market refers to illegal trading activities that occur outside the boundaries of the formal economy.

Economic Impact Of Black Markets

As an example of a black economy, a construction worker who is paid under the table will neither have taxes withheld, nor will the employer pay taxes on his earnings. The construction work is legal; it is the nonpayment of taxes that classifies the event as part of the black economy. Other purely illegal transactions—something that varies widely by jurisdiction—are part of the black economy by default. These include obvious things like selling illegal substances and weapons, as well as activities that are highly dependent on local laws, such as doing a renovation without a permit or receiving payment for a sexual act. People will often hide their actions from law enforcement agents, tax officials, and other regulators if laws prohibit them from purchasing and selling the products and services they want.