Stay vigilant and continue to monitor your financial statements and credit reports regularly for any signs of unauthorized activity. If your SSN was leaked, check your credit reports (Experian, Equifax, and TransUnion) for any unauthorized activity (and do so regularly going forward!). Report any suspicious transactions to the credit bureaus, via their websites, and place a credit freeze to prevent new accounts from being opened in your name.

Tips To Keep Your Social Security Number And Personal Information Away From Hackers

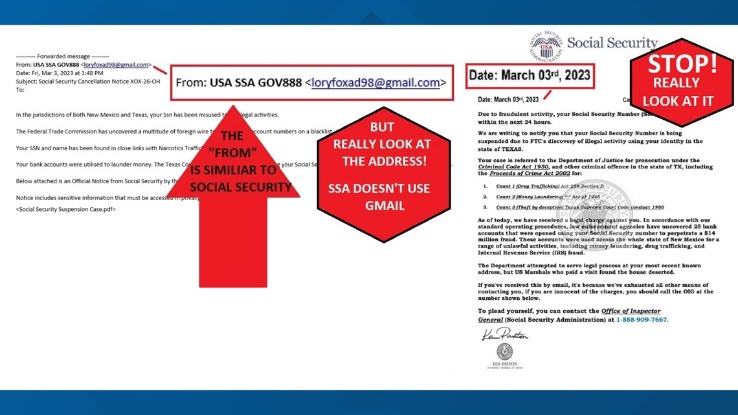

Avoid providing your SSN unless it’s legally required, such as for tax filing, employment, or government services. If you aren’t sure if your SSN is on the dark web, you’ll want to check first. Unfortunately, searching the dark web for your SSN without the needed technical know-how and specialized tools, such as a secure operating system, Tor browser, and VPN, can be extremely risky. We don’t recommend you try it due to the dangers and potential legal implications involved.

Check Your Credit Reports And Bank Statements

When you freeze your credit, you prevent fraudsters from accessing your credit file. Having your Social Security Number (SSN) exposed on the dark web presents a threat to your identity and financial security. Misuse of this sensitive information can lead to fraud, such as opening new credit accounts, filing fraudulent tax returns, or obtaining medical services in your name. Taking prompt action is essential to mitigate harm and protect against identity theft, significantly reducing financial loss. Taking steps such as contacting the authorities, notifying your financial institutions, and monitoring your credit reports are crucial for mitigating the impact of having your SSN on the dark web.

Get An Identity Protection PIN

- As a precaution, you should contact your provider and ask them to “lock” your SIM with a custom PIN.

- Companies typically send letters or notifications to their customers whose Personally Identifiable Information (PII) was exposed during a data breach.

- The FICO Score 8 gives you a good sense of your credit health but it may not be the same score model used by your lender or creditor.

- It allows the government to track your income, and it’s useful when opening accounts, claiming benefits, and more.

- Then, join LifeLock for dark web monitoring and other powerful identity theft protection features.

The FICO Score 8 gives you a good sense of your credit health but it may not be the same score model used by your lender or creditor. An incorrect Social Security number on your credit report could be a sign of fraud, but it also may just be a typographical error. Be sure to review your credit report carefully to see if there are any other indicators of fraud, such as unfamiliar names or addresses, or accounts that you didn’t open. If a Social Security Number variation is the result of a typographical error, you may contact the creditor that reported the incorrect number and request a change to their records. CreditWise lets you monitor your FICO Score 8 and get alerts when important changes are made to your TransUnion and Experian credit reports.

Not Every Data Breach Will Result In Identity Theft, And Not Every Identity Theft Is Tax-related Identity Theft

To file an identity theft report with the FTC, visit IdentityTheft.gov. You can also use the same resource to get a customized fraud recovery plan. Consider an SSN monitoring tool like Aura to alert you if your personal information is being illegally used.

Warning Signs Of Social Security Number Identity Theft

We gather data from the best available sources, including vendor and retailer listings as well as other relevant and independent reviews sites. And we pore over customer reviews to find out what matters to real people who already own and use the products and services we’re assessing. Additional detailed information is available and the video recording of a recent town hall. In the meantime, campus IT officials encourage everyone to report any suspicious email or telephone calls by contacting IT staff at email protected . Services like Experian or Norton monitor the dark web for your SSN and other personal data, alerting you if your information is found. While you’re at it, we recommend you use a reliable password manager like NordPass to securely store all your new passwords.

Social Security Data Leak: 7 Steps To Take If You’ve Been Affected

While legal organizations may tout the idea that money damages may be available to people affected by the breach, any sums that are eventually paid likely won’t be meaningful, Lee said. Keep in mind—there is no foolproof way to know if someone is using your Social Security number. So, while a Social Security account can help protect your benefits, it doesn’t safeguard the number itself. If you think your SSN is floating around on the dark web, don’t hesitate to check with Aura.

Avoid this scam’s frustrating legal and financial consequences and learn how to better protect your personal information from Social Security number identity theft. File an online complaint with the Internet Crime Complaint Center, which monitors cybercrime complaints to combat internet crime. It’s also advisable to check your credit report every so often to detect any fishy behavior as it happens. There are tools available that will monitor what information about you is available on the dark web, noted Michael Blair, managing director of cybersecurity firm NukuDo.

If you think or know your SSN was leaked to the Dark Web, you can take steps to minimize the damage and protect yourself from identity theft and fraud. If your SSN is found on the Dark Web, it’s nearly impossible to remove. Instead, you should try to figure out what additional information has been compromised — such as your credit card numbers, home address, or phone number — so you can mitigate the damage.

Whether your SSN has already been stolen or not, you should take some preventative measures to protect your personal information in the future. Are you concerned your Social Security number (SSN) may be on the dark web? Your SSN is considered one of the most sensitive pieces of information because of the damage criminals can do if they manage to steal it. The Social Security Administration also provides online access to your earnings and benefits history through its my Social Security account.

Before delving into the action steps, it’s important to understand the dark web and why finding your SSN there is cause for concern. If you find you’re included in the breach, the steps you should take are not necessarily new. By entering your name, you may get a sense of what information, if any, has been shared.

Now he’s decided that he’s worked enough to last two lifetimes and finally retired in 2014. When two-factor authentication is enabled, a code is required in addition to your username and password to log in. If you find out that your SSN is on the dark web, then your personal information has most likely already been compromised. It might be impossible to remove it from there altogether, but there are certain measures you can take to minimize your exposure. If you believe one of the above scenarios is applicable to you, follow these steps on how to change your Social Security number.

As long as you stay vigilant, take quick action, and keep your personal information secure, you can reduce threats to a minimum. NordPass is here to help keep your sensitive information safe and out of the wrong hands. It’s unlikely that criminals will care to remove one data point from a single user request – even if you were able to find a way to contact them.

If you suspect your social security number has been stolen, you need to take action immediately. Most crimes occur within 24hrs of obtaining your personal information, some of which could take years to fix. Ultimately, the best thing you can do to protect yourself from identity theft is keep your sensitive information private, secure, and off the Dark Web. If a scammer has already used your SSN to open new accounts, contact the companies immediately.

Regularly monitor your credit reports and financial statements for any suspicious activity. If you’re concerned that your data’s been being used against you, it’s time to use an identity theft protection and credit monitoring service to protect yourself. Enable two-factor authentication (2FA) for sensitive accounts, use unique passwords, and update them regularly. This adds an extra layer of protection against hackers and data breaches. Beyond credit protection, immediately change passwords for all online accounts, especially financial, email, and social media accounts. Use strong, unique passwords for each account and enable two-factor authentication (2FA) wherever possible.